StartGround - Deals - Finance Software - Mercury Deal 2026: Claim $250 Credit Promo

Mercury Deal 2026: Claim $250 Credit Promo

Written By:

Pradeep Singh

Last Updated: January 4, 2026

Disclosure: This post may contain affiliate links, meaning if you decide to make a purchase via my links, I may earn a commission at no additional cost to you. See my disclosure for more info.

If you’re looking for a smarter way to manage your startup’s finances, the Mercury deal gives you a strong head start. When you open a Mercury account and deposit $10,000 within the first 90 days, you earn a $250 cash reward. Get this offer and put more into your business while enjoying a modern banking experience built specifically for founders and small businesses.

Mercury goes beyond just providing checking and savings accounts through their partner banks. You gain access to seamless tools that simplify your day-to-day financial operations, from sending payments to managing team expenses.

With no required monthly fees or minimum balance requirements, this deal offers you a cost-effective way to enjoy advanced banking features while getting an added boost with the $250 bonus.

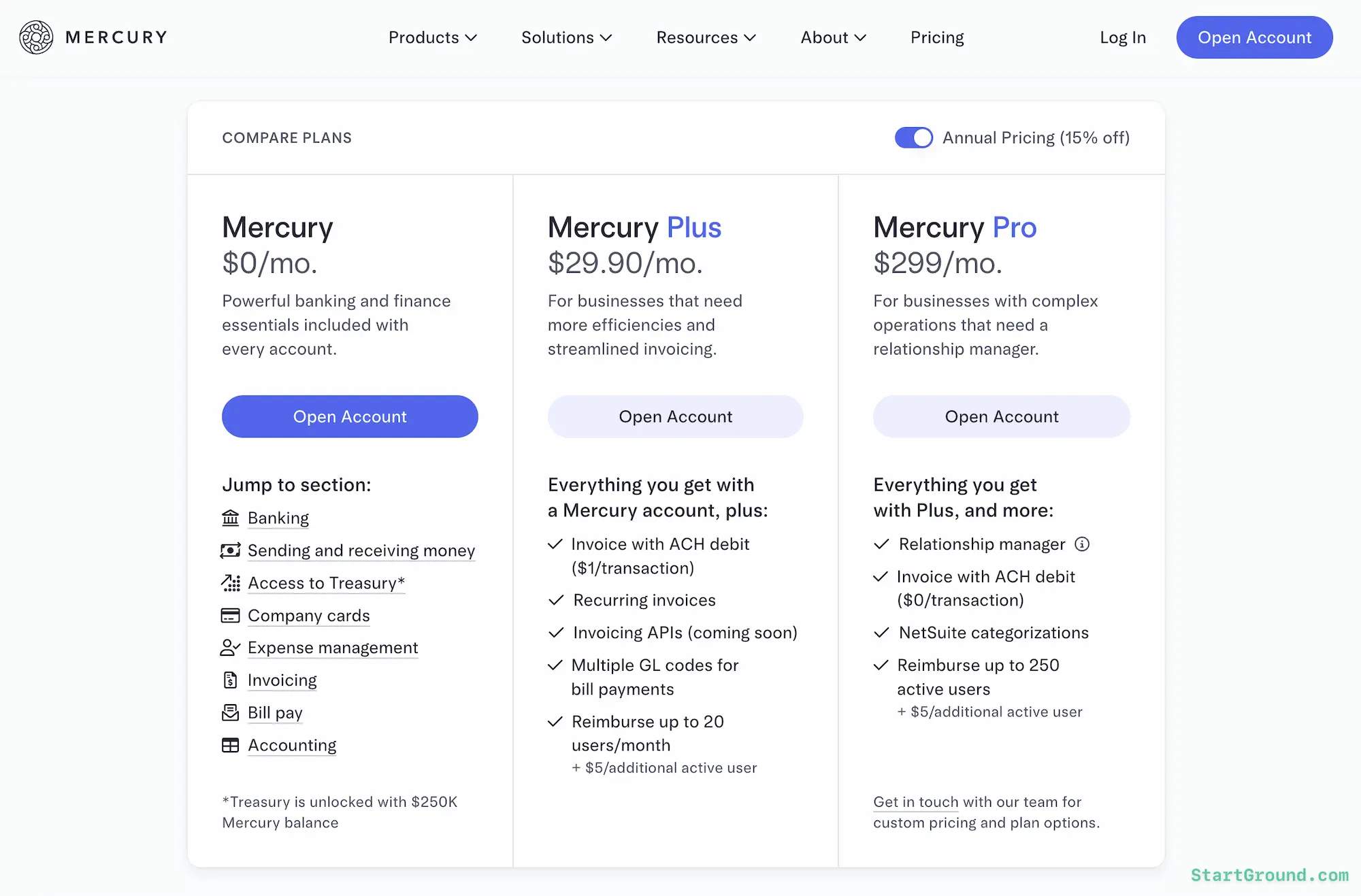

Mercury Pricing

Mercury structures its pricing so you can start with essential banking tools for free and upgrade only when your business requires advanced features.

All accounts include $0 monthly fees for access to core banking, debit and credit cards, payments, and access to powerful integrations. If you want to streamline invoicing, expand team reimbursements, or gain dedicated support, you can choose one of the paid tiers.

Here’s a clear comparison of Mercury’s pricing:

| Plan | Monthly Price | Annual Price (15% OFF) | Best For |

|---|---|---|---|

| Mercury (Standard) | $0 | $0 | Founders who need powerful banking essentials at no cost. |

| Mercury Plus | $35/month | $299/year | Businesses that want advanced invoicing features, including ACH debit, and reimbursements for up to 20 users. |

| Mercury Pro | $350/month | $2,995/year | Larger companies needing NetSuite categorizations, expanded reimbursements for up to 250 users, and a dedicated relationship manager. |

With the annual discount, you save 15% on paid plans, making Mercury Plus and Mercury Pro more cost-effective for growing businesses. You can start with the free standard plan and only move up when your operations demand it, ensuring you never overpay for features you don’t yet need.

Mercury Overview

Mercury is a modern banking* platform created with startups and small businesses in mind. Instead of dealing with outdated systems, you gain access to a digital-first solution that simplifies financial management. From opening your account online to handling everyday transactions, Mercury keeps your focus on building your business rather than navigating complex banking processes.

The platform covers essential services like checking and savings accounts, corporate cards**, and seamless payment processing. It integrates smoothly with leading accounting tools such as QuickBooks, Xero, and NetSuite, allowing you to keep your books accurate without repetitive manual work. With no hidden fees or requirements to maintain a minimum balance, Mercury gives you the flexibility to run your finances without unnecessary overhead.

Beyond core banking, Mercury also supports your growth journey. Treasury*** options, powered by Mercury Advisory, can be accessed once your balance reaches $250,000and may help you earn yield on idle funds. Plus, their free resources, tools, and events help to give you the insights and connections you need to scale. This combination of financial productss and community resources makes it more than just a banking solution—it becomes part of your startup’s ecosystem.

Mercury Features

Mercury offers more than basic banking*. Its features are designed to give you control, flexibility, and efficiency while your business grows. Here are the highlights:

Banking and Payments

You get FDIC-insured* checking and savings accounts provided through Mercury’s partner banks. Sending and receiving domestic and international USD wires is free, and you can make payments without worrying about hidden charges.

Company Cards

Mercury provides physical and virtual debit and credit cards for your team. Every purchase earns 1.5% cashback, helping you put money back into the business while managing everyday expenses.

Expense Management

Built-in tools make it simple to handle team reimbursements. You can easily set granular controls and spend policies in place to manage team spend. The Plus plan covers up to 20 users per month, while the Pro plan expands reimbursements to 250 users. Clear controls and permissions help you stay on top of spending.

Invoicing and Bill Pay

Mercury lets you create unlimited invoices and pay vendors directly through the platform. Recurring invoices, ACH debit options, and multiple general ledger codes make accounting easier, especially for service-based businesses.

Integrations and Automation

You can connect Mercury with tools like Xero, QuickBooks, and NetSuite. Transactions sync automatically, so reconciliation takes less time and errors are reduced. For larger teams, invoicing APIs and advanced categorization in NetSuite simplify workflows even further.

Treasury and Yield

When your Mercury balance reaches $250,000, you unlock access to Mercury Treasury*** accounts that can earn attractive returns on idle funds. This feature helps your cash work harder without the complexity of traditional investment processes.

Security and Compliance

Every transaction is protected with advanced security, including two-factor authentication and fraud monitoring. Your deposits also benefit from FDIC insurance* through Mercury’s partner banks, with coverage far above the standard limit.

Mercury Pros and Cons

Mercury offers a lot of value to startups and growing businesses, but like any platform, it has strengths and a few limitations. Here’s a balanced view to help you decide if it fits your needs:

Pros

- Transparent pricing: No hidden fees and free access to core banking tools.

- Seamless integrations: Syncs with accounting software like QuickBooks, Xero, and NetSuite.

- High FDIC insurance*: Coverage extends well beyond standard limits through partner banks.

Cons

- Reimbursement caps on lower plans: Free and Plus tiers limit how many users you can reimburse monthly.

- Digital-first approach: Limited support for businesses that still rely on physical checks.

- Extra costs for some features: Advanced ACH debit transactions may add small fees outside higher-tier plans.

Mercury Deal FAQs

How does the Mercury deal work?

When you open an account through Mercury and deposit $10,000 within your first 90 days, you qualify for a $250 cash bonus. The reward goes directly into your account once the requirement is met. Additional terms apply.

Who is eligible for this Mercury offer?

The deal is available to US-based businesses. You need to have a registered entity in the United States to open an account and claim the bonus.

Do I need to pay monthly fees to access Mercury deal?

No. You can open an account for free and still receive the $250 bonus once you complete all eligibility requirements. Paid plans are optional if you want access to the advanced features.

How long does it take to receive Mercury’s bonus Offer?

Once you’ve deposited $10,000 within 90 days of your account opening, Mercury will processes payouts within five weeks. Delays may occur occasionally.

Our Mercury Review

Mercury stands out as one of the most startup-friendly banking platforms available today. It delivers a combination of modern design, automation, and financial tools that help founders focus more on growth and less on administrative tasks. The $250 cash bonus adds real value at the very beginning of your banking journey, making it even more appealing for new businesses looking to stretch their resources.

The pricing structure is fair, with a solid free plan for essential banking needs and cost-effective paid tiers that unlock advanced invoicing, reimbursement, and support options. The 15% annual discount on paid plans makes it easier to justify an upgrade when your business scales.

What makes Mercury especially compelling is how it blends banking with startup resources. From investor connections through Mercury Raise to Treasury options for optimizing idle cash, it’s clear that the platform is designed to evolve with your business. Security measures, enhanced FDIC coverage, and integrations with accounting software give you peace of mind while keeping operations smooth.

Mercury

Mercury offers modern banking and financial solutions designed for startups and small businesses.

Price Currency: USD

Application Category: BusinessApplication

5

Pros

- No required monthly fees.

- Strong integrations.

- High FDIC coverage* on deposits.

Cons

- Reimbursement caps.

- Few physical check options.

- Fees on some ACH debits.

If you’re a founder or small business owner seeking reliable, transparent, and growth-oriented banking, Mercury is a strong choice. The current deal makes it even more worthwhile to get started and experience its features firsthand.

Mercury is a fintech company, not an FDIC-insured bank. Checking and savings accounts are provided through our bank partners Choice Financial Group, Column N.A., and Evolve Bank & Trust; Members FDIC. Deposit insurance covers the failure of an insured bank. Checking and savings account deposits may be held by sweep network banks. Certain conditions must be satisfied for pass-through insurance to apply. Learn more here.

**The IO Card is issued by Patriot Bank, Member FDIC, pursuant to a license from Mastercard®. To receive cash back, your Mercury accounts must be open and in good standing, meaning they cannot be suspended, restricted, past due, or otherwise in default.

***Mercury Treasury, offered by Mercury Advisory, LLC, an SEC-registered investment adviser, seeks to earn net returns up to 4.26% annually on your idle cash. Net return or yield provided assumes total Mercury deposits of $20M+, is accurate as of 09/01/2025, and is subject to change.

This communication does not constitute an offer to sell or the solicitation of any offer to purchase any security. Funds in Mercury Treasury are subject to investment risks, including possible loss of the principal invested, and past performance is not indicative of future results. Some of the data contained in this message was obtained from sources believed to be accurate but has not been independently verified. Please see full disclosures at mercury.com/treasury. Mercury Advisory is a wholly-owned subsidiary of Mercury Technologies.

Mercury Treasury is not insured by the FDIC. Funds in Mercury Treasury are not deposits or other obligations of Choice Financial Group, Column N.A., or Evolve Bank & Trust, and are not guaranteed by Choice Financial Group, Column N.A., or Evolve Bank & Trust.

Tags:

Author: Pradeep Singh

Pradeep Singh is an entrepreneur and founder of StartGround, a platform dedicated to empowering startups and entrepreneurs with the best software deals and resources. With years of experience building and guiding startups to success, he’s passionate about connecting entrepreneurs to essential tools and growth opportunities.